PAYROLL SERVICES FOR RICHLAND, KENNEWICK AND PASCO BUSINESSES

PAYROLL SERVICES in TRI-CITIES, WA

In today’s modern world, payroll shouldn’t be a big headache. If your payroll system has you drowning in paper, checks, and reports, it’s time to outsource your payroll to PorterKinney

To process payroll simply provide employee hours, commissions, and bonuses to your payroll specialist, and we will run the payroll. We process all of the payroll reports and taxes for you behind the scenes. Give us a call today at 509-713-7300 to find out how affordable it can be to outsource your payroll system.

STUCK WITH AN OUTDATED PAYROLL SYSTEM?

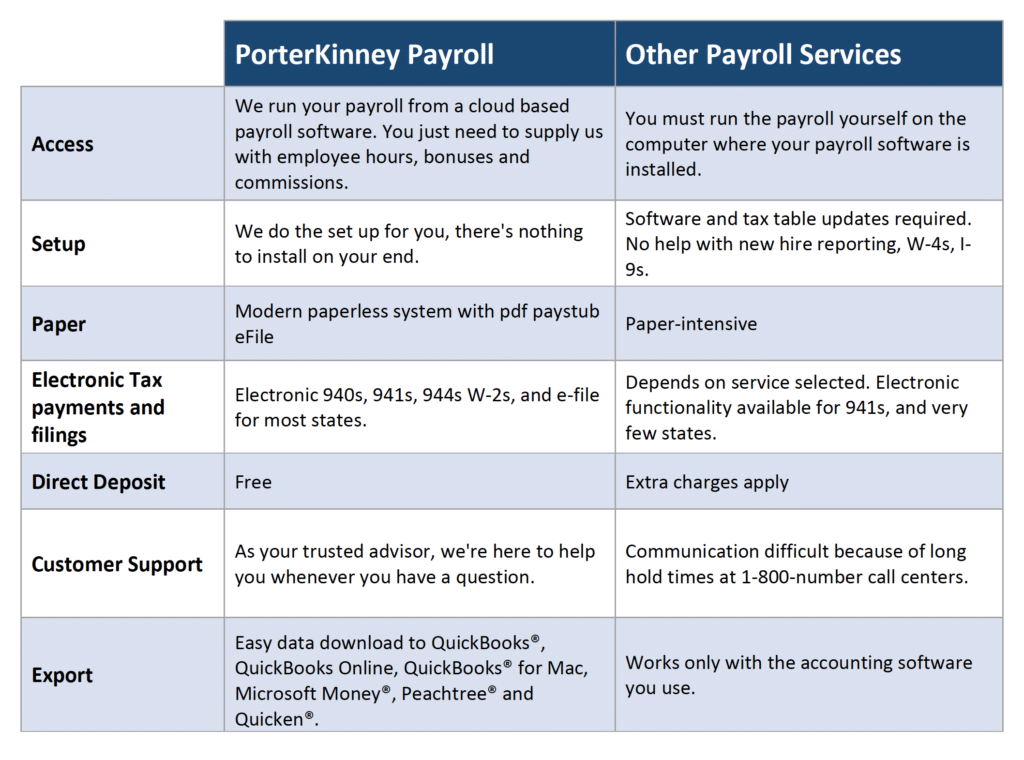

Check out this chart to see how we are different.

COMPLETE AND CUSTOMIZED PAYROLL SERVICES

PorterKinney in Richland, WA offers complete and customized payroll services for businesses of all sizes. Depending upon the size of your business, payroll may be one of the most complex tasks your administrative staff handles. Payroll involves more than simply writing checks to your employees.

Typical Payroll Services

One of the biggest headaches of a typical, outdated payroll system is the low-quality support. Even some of the most recognizable payroll providers, have long hold times at their 1-800-number call centers. No business owner should need to spend hours to get answers to their payroll questions.

Typically, payroll begins with employee timekeeping records. In addition to paying your employees, you must also account for payroll taxes owed to federal, state and local agencies. In addition, your employees may pay for a portion of their benefits, including health care premiums, life insurance and retirement contributions. As an employer, you may be required to calculate, withhold and pay the taxes you collect.

A worker’s payroll data accumulates throughout the year. Periodically, you’ll be required to remit the employment taxes you have collected to the appropriate federal, state or local government agencies. When you submit your tax payments, you are also required to submit a number of documentary forms to the agencies that collect taxes. Generally, you will forward tax payments and the accompanying documentation to the appropriate agencies on a quarterly or annual basis.

Some payroll software programs may not allow you to submit electronic payments and forms. Others may not calculate local taxes, or handle special employee deductions very well. For example, an employee may be required to make child support or other court-ordered payments. If your payroll software does not manage this, you may need to make manual entries to calculate, withhold and forward these payments correctly.

Your payroll software may or may not support electronic filings for common forms, including Forms 940 and 941, and forms that are specific to Washington, or to the states in which you conduct business. Further, your payroll software may or may not fully integrate into other accounting software you use to manage your business.

PorterKinney Outsourced Payroll

PorterKinney offers a better payroll solution for Tri-Cities, WA businesses of all sizes. Our payroll services allow you to save time by having a trained payroll specialist process your payroll and payroll reports. This makes your payroll independent from a specific computer in your office. It also means you can free up yourself and your administrative staff for other tasks while we manage your payroll.

With PorterKinney’s outsourced payroll services, we take care of the setup for you. There’s nothing to install at your business. You simply supply the appropriate information, such as employee information, tax identification numbers and account numbers, and our payroll specialist will do the rest.

Better still, PorterKinney can help you eliminate the reams of paper that your current payroll system may generate. Your employees may have online access to their payroll records and receive .pdf payroll information. In addition, the system can electronically file your required payroll forms, including 940, 941, 944, W-2 and state tax filings. Our system virtually eliminates the labor involved in creating the year-end reporting your employees need to file their personal tax returns. Our outsourced payroll service also provides free direct deposit for paychecks, a time-saving and highly-secure feature.

PorterKinney’s outsourced payroll services are easy to use, on-time and accurate. Additionally, we eliminate the time-intensive tasks associated with payroll and taxes, so your staff can focus confidently on other responsibilities.

If you would like more information about PorterKinney’s payroll services, and how they can streamline your back-office processes, please call us at 509-713-7300. You can also email us at info@porterkinney.com, or fill out our contact form and we’ll arrange a free consultation for your business.